USDT Price History:

Key Things to Know About Tether Price

As a pioneering stablecoin, Tether (USDT) holds a unique place in cryptocurrency history. Launched in 2014, it introduced the concept of a digital token pegged 1:1 to the U.S. dollar. This article explores Tether's history, examines its price fluctuations, and explains the mechanism it uses to maintain its value.

What Is Tether (USDT)?

Tether (USDT), launched in 2014 by Tether Limited, is a stablecoin designed to maintain a value equivalent to the U.S. dollar. This 1:1 peg minimizes price volatility, making USDT a popular choice for trading, transferring funds, and hedging against market fluctuations.

The core principle of USDT is that each token is backed by reserves held by the company. This backing ensures that the value of circulating tokens corresponds to the company's assets, providing stability.

The History of Tether

Tether began on the Bitcoin blockchain using the Omni Layer protocol. Initially called Realcoin, it was co-founded by Reeve Collins, Brock Pierce, and Craig Sellars, who aimed to create a transparent and stable digital currency. The project was rebranded as Tether in late 2014, and by 2015, USDT was available on several major cryptocurrency exchanges.

Key Features of Tether

As the leading stablecoin, USDT has several defining features:

- Pegged Value: USDT is designed to maintain a 1:1 peg to the U.S. dollar, offering a stable asset in the volatile crypto market.

- Asset Backing: Every token is backed by an equivalent value of assets held in reserve by Tether Limited.

- Primary Uses: Traders use USDT to transfer funds between exchanges, manage risk, and protect value during market downturns.

- Blockchain Support: The token is available on numerous blockchains, including Ethereum, TRON, BNB Chain, and Avalanche.

- Issuance and Redemption: New USDT tokens are created when users deposit dollars and are removed from circulation (burned) when redeemed. USDT cannot be mined or staked.

- Transparency Reports: Tether publishes regular attestation reports on its reserves, though the composition and sufficiency of its backing have been subject to public scrutiny.

Tether (USDT) Overview

| USDT Price | $1.00 |

| Price Change 24h | +0.01% |

| Price Change 7d | -0.01% |

| Market Cap | $112,800,000,000 |

| Circulating Supply | 112,800,000,000 |

| Total Supply | 116,100,000,000 |

| Trading Volume 24h | $51,872,162,857 |

| All-Time High (ATH) | $1.32 |

| All-Time Low (ATL) | $0.57 |

How Does Tether (USDT) Work?

Tether maintains its 1:1 peg to the U.S. dollar by backing each issued token with assets held in reserve. In theory, for every 1 USDT in circulation, the company holds $1 worth of assets. If USDT's market price deviates from $1, Tether can theoretically stabilize the price by issuing or redeeming tokens.

A USDT token represents a claim on Tether's reserves, not a literal U.S. dollar. According to its Q1 2024 report, the company's assets of over $113 billion exceeded its liabilities of approximately $104 billion, indicating full backing for circulating tokens at that time. These reserves are composed of cash, cash equivalents, and other assets, though the precise composition and quality have historically been subjects of debate.

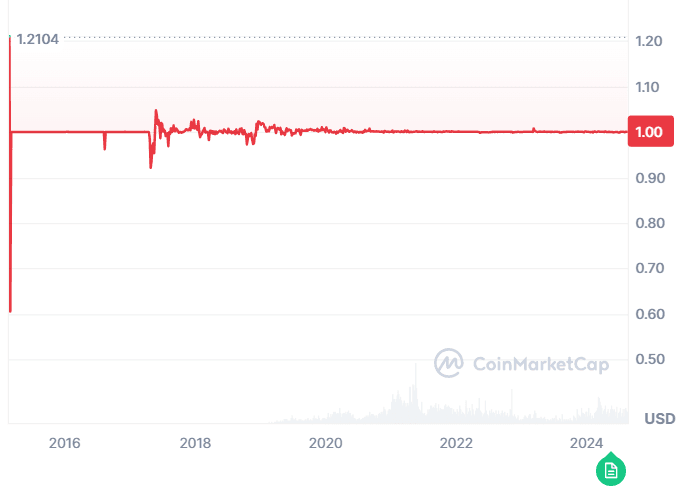

Tether (USDT) Chart

Key Tether Market Metrics

Analyzing key market indicators helps in understanding USDT's role in the digital asset market.

Market Capitalization and Price

USDT consistently holds the largest market capitalization among all stablecoins, ranking it among the top cryptocurrencies globally. With a market cap of approximately $112.8 billion, its value reflects the total number of tokens in circulation, each maintaining a price consistently close to its $1.00 peg.

Trading Volume and Liquidity

With a daily trading volume that often surpasses $50 billion, USDT is one of the most liquid digital assets. This high liquidity signifies strong market demand and ensures that traders can execute large buy or sell orders with minimal price impact, making it a cornerstone of crypto trading.

USDT Rate Fluctuations

Although Tether is designed for stability, its history includes several notable price fluctuations. In its early days in 2015, low liquidity led to significant volatility, causing the price to hit an all-time low of approximately $0.57 and a high of $1.32.

The price later stabilized but experienced temporary deviations from its peg. It dropped to $0.91 in April 2017 amid banking concerns and fell to $0.95 in October 2018 during a wider market crash. In May 2019, it dipped to $0.94 following an investigation related to its sister company, Bitfinex. While the peg was re-established after each event, these instances demonstrate that a perfect 1:1 parity is not always guaranteed.

Conclusion

Tether (USDT) serves a foundational role in the digital currency ecosystem as the leading stablecoin. Despite facing historical price fluctuations and scrutiny over its reserves, it remains one of the most widely used and liquid digital assets. The ability of Tether Limited to maintain its peg and provide transparency remains critical to retaining the trust of its global user base.

Frequently asked questions

-

What is Tether (USDT)?

Tether (USDT) is a stablecoin, a type of cryptocurrency designed to maintain a stable value. Its value is pegged 1:1 to the U.S. dollar, meaning one USDT is intended to be worth one U.S. dollar. -

How does USDT maintain its value?

USDT maintains its value through asset backing. The issuer, Tether Limited, holds reserves of cash, cash equivalents, and other assets intended to be equal to or greater than the value of all USDT in circulation. This backing helps keep the market price stable. -

Has USDT ever lost its 1:1 peg to the U.S. dollar?

Yes, on several occasions, USDT has temporarily deviated from its $1 peg due to market stress, liquidity issues, or concerns about its reserves. Historically, it has always returned to its $1 valuation after these events. -

What are the primary uses of USDT?

USDT is primarily used by cryptocurrency traders to move funds between exchanges quickly, hedge against the volatility of other cryptocurrencies, and serve as a stable store of value within the digital asset ecosystem. -

Is holding USDT risk-free?

No, holding USDT is not risk-free. Risks include the potential for the token to de-peg from the U.S. dollar, counterparty risk related to the solvency and transparency of its issuer (Tether Limited), and regulatory risks.

Our website uses cookies. Our Cookie Policy