USDT Price Prediction:

Tether Price Forecast

Tether (USDT) is the leading stablecoin pegged to the U.S. dollar, serving as a popular entry point for many into the cryptocurrency market. As a stablecoin, its value is designed to mirror a fiat currency, but USDT has occasionally experienced price fluctuations. This guide explores Tether's future outlook and its ability to maintain its dollar peg.

What Is Tether (USDT)?

Tether (USDT) is a stablecoin engineered to maintain a 1-to-1 value with the U.S. dollar. Originally launched as Realcoin by Reeve Collins, Brock Pierce, and Craig Sellars, it was created to be a stable and transparent digital currency. As the most widely used stablecoin, USDT offers a way to store value and transfer funds with the stability of fiat currencies, avoiding the extreme volatility common to other cryptocurrencies. It functions as a bridge between traditional finance and the crypto world, providing transparency and low transaction fees. While it first launched on the Bitcoin blockchain using the Omni Layer protocol, USDT has since expanded to operate on over 15 blockchains, including Ethereum (ERC-20), TRON (TRC-20), and BNB Chain (BEP-20).

Tether (USDT) Price Overview

As of June 2024, Tether (USDT) maintains its price at approximately $1.00, with minor daily and weekly fluctuations typical for a stablecoin. Its market capitalization stands at over $112 billion, with a circulating supply of nearly 112.5 billion USDT out of a total supply of about 115.8 billion USDT. The 24-hour trading volume often exceeds $45 billion. Historically, USDT's price has shown some volatility, reaching an all-time high of $1.32 and an all-time low of $0.57.

Technical Features to Know

Key Technical Features

Tether's maximum supply is not capped; new tokens are minted or burned according to the funds held in its reserves. The first tokens were issued on the Bitcoin blockchain in 2014. USDT is versatile, operating on more than 15 blockchains, including major networks like Bitcoin, Ethereum, TRON, BNB Chain, Algorand, and Avalanche. It holds a significant market dominance of over 4.5% in the total cryptocurrency market.

USDT Crypto: Price History

Tether (USDT) is the world's largest stablecoin by market capitalization and has largely maintained its value near $1, even as other stablecoins have failed. However, USDT's history includes several notable price fluctuations. After it began trading in 2015, its value once fell to about $0.57 amid low demand. In July 2018, USDT briefly surged to an all-time high of $1.32. Its price was relatively stable until April 2017, when it dipped to $0.91. During the crypto market crash in October 2018, Tether's value temporarily dropped to $0.95. Another dip to $0.94 occurred in May 2019 following concerns about the adequacy of its reserves. Despite these episodes, Tether has consistently recovered its peg.

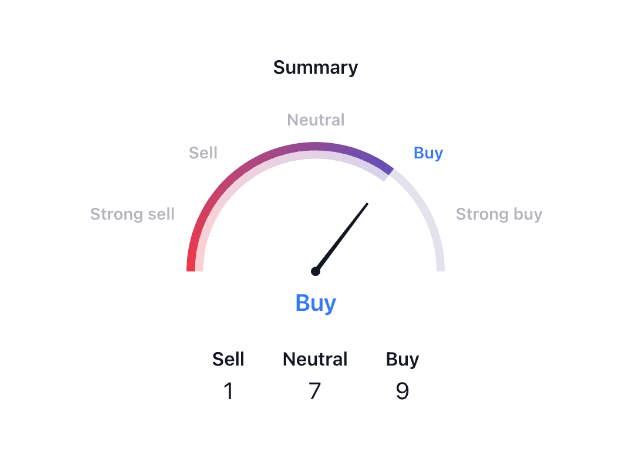

Tether Technical Analysis

While standard technical analysis is not typically applied to stablecoins like USDT, price charts can reveal short-term market sentiment on exchanges. The TradingView USDT/USD chart often indicates a neutral or slight buy sentiment, suggesting that traders expect the peg to remain stable. This type of analysis focuses more on gauging market confidence in Tether's stability rather than predicting future price growth.

Tether (USDT) Price Prediction by Experts

Expert forecasts for Tether concentrate on its capacity to maintain its $1 peg, not on price appreciation. Most analyses project continued stability. For instance, WalletInvestor expects USDT to hover around $1.00 through 2030. Similarly, DigitalCoinPrice and TradingBeasts predict that Tether will hold its value close to $1.00, with only minor fluctuations inherent to a stablecoin. These predictions align with USDT's fundamental purpose as a stable medium of exchange, not a speculative asset.

Tether (USDT) Price Prediction by Years

Tether (USDT) Price Outlook for 2025-2030

Predicting the price of Tether is different from forecasting volatile cryptocurrencies. The primary expectation for USDT from 2025 through 2030 is that it will maintain its 1-to-1 peg with the U.S. dollar, keeping its price at or very near $1.00.

Instead of price fluctuations, the key factors shaping Tether's future are:

- Regulatory Scrutiny: Increased oversight from global financial regulators could impact Tether's operations and reserve management policies.

- Reserve Transparency: The quality and transparency of the assets backing USDT will remain critical for maintaining market confidence. Tether has been improving its reporting, and this trend will need to continue.

- Market Competition: The rise of other stablecoins, including fully regulated ones like USDC and potential central bank digital currencies (CBDCs), will challenge USDT's market dominance.

- Adoption and Utility: Tether's continued integration into DeFi platforms, exchanges, and cross-border payment systems will support its relevance and stability.

Any significant deviation from the $1.00 peg would be a major event, not a normal market movement. Therefore, the long-term forecast is a measure of its reliability rather than a prediction of price growth.

Features and Prospects

The adoption of stablecoins is growing, as these digital assets are valued for their stability as a medium of exchange. While Tether leads the market, it faces competition from other stablecoins like USD Coin (USDC), Dai (DAI), and Pax Dollar (USDP). Binance USD (BUSD) is being phased out and is no longer a significant competitor. In contrast, algorithmic stablecoins, which lack collateral backing, have a history of poor performance and are prone to collapse. Traders rely on USDT for liquidity to enter and exit trades while hedging against market volatility. Unlike speculative assets, stablecoins like Tether are designed to store value. They also serve as an excellent tool for businesses accepting digital payments without the price risk of assets like Bitcoin. Tether supports its tokens with reserves that include cash and cash equivalents, such as U.S. Treasury bonds, which provides a layer of security.

Conclusion

Stablecoins like USDT are essential tools in the digital economy, providing stability in a volatile market. Tether's future centers on maintaining its U.S. dollar peg, a task it has accomplished through various market cycles. For investors and traders, USDT acts as a safe haven against market swings and a practical instrument for transactions. As the digital finance landscape evolves, Tether's continued relevance will depend on its transparency, regulatory compliance, and ability to outperform competitors, solidifying its role as a cornerstone of the cryptocurrency ecosystem.

Frequently asked questions

-

What is Tether (USDT) and how does it maintain its value?

Tether (USDT) is a stablecoin intended to hold a 1-to-1 value with the U.S. dollar. It maintains this peg by holding reserves of assets, such as cash and U.S. Treasury bonds, equal to or greater than the value of USDT in circulation. This collateral backing ensures each token's stability. -

What are the primary uses of USDT?

USDT is primarily used as a stable store of value to avoid the volatility of other cryptocurrencies. Traders also use it to move funds between exchanges, hedge portfolios, and facilitate cross-border payments. It is also a key component in many decentralized finance (DeFi) applications. -

What are the risks associated with using Tether?

The main risks include potential regulatory actions, as governments are still defining rules for stablecoins. There are also ongoing concerns about the transparency and composition of Tether's reserves. A failure to honor redemptions or a significant loss of market confidence could cause USDT to lose its dollar peg. -

How does Tether differ from Bitcoin?

Tether is a centralized stablecoin pegged to the U.S. dollar, designed for price stability. In contrast, Bitcoin is a decentralized cryptocurrency with a volatile price, intended as a store of value and a peer-to-peer payment system. Their underlying technology, purpose, and market behavior are fundamentally different. -

Has USDT ever lost its peg to the US dollar?

Yes, USDT has experienced temporary deviations from its $1.00 peg, especially in its earlier years. Historically, its price fell as low as $0.57 and briefly rose to an all-time high of $1.32. However, in recent years, it has maintained its peg with significantly greater stability.

Our website uses cookies. Our Cookie Policy