Step-by-Step:

Buy Curve DAO Token with Your Local Currency

Benefits of buying Crypto with Switchere

-

Low exchange fees

Transparent and market-competitive pricing for crypto operations.

-

Fast payment processing

Lightning-fast 3DS transaction processing and robust PCI security standards.

-

24/7 customer care

A frontline and professional customer care team is available round the clock.

Buy Curve DAO Token Instantly /

The Fastest Way to Buy Crypto

Your Gateway to Acquiring Curve DAO Token (CRV) Securely and Swiftly

The Curve DAO Token (CRV) stands as a cornerstone of the decentralized finance (DeFi) ecosystem, powering the Curve.fi protocol, a leading decentralized exchange for stablecoins. Acquiring CRV means gaining a stake in one of DeFi's most crucial platforms. Switchere provides a streamlined and secure access point for users looking to purchase CRV. Our platform is engineered to be an efficient fiat-to-crypto on-ramp, allowing you to use familiar payment methods to enter the world of digital assets. We bridge the gap between traditional finance and DeFi, making it straightforward to buy Curve DAO Token (CRV) without navigating complex trading interfaces. Through our trusted partners, every transaction is handled with precision and speed, ensuring a seamless experience from start to finish.

The process is designed for clarity and ease of use. Whether you are using our website or the intuitive Switchere mobile app, available for both iOS and Android, acquiring CRV is just a few clicks away. We prioritize a hassle-free user journey, which is why we collaborate with partners who manage a flexible KYC system. This verification process, tailored to comply with international regulations and anti-money laundering (AML) standards, ensures the platform remains secure for all users. The level of verification may vary depending on your location and chosen payment method, offering a balanced approach between accessibility and compliance. Once verified, you can proceed with your purchase, and the CRV tokens will be sent directly to your personal digital wallet, as Switchere does not hold or manage user assets. This non-custodial approach gives you full control over your cryptocurrency.

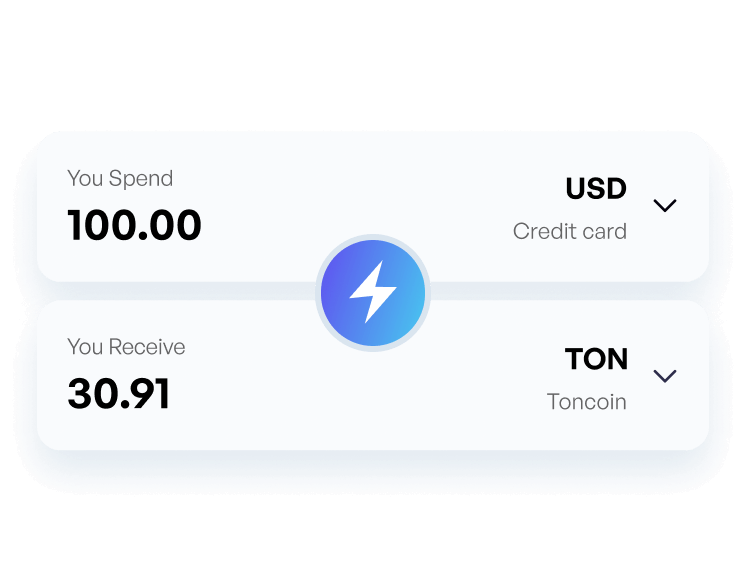

Transparent Pricing and Diverse Payment Options

Understanding the cost of your transaction is paramount. At Switchere, we believe in full transparency. Before you confirm a purchase, our integrated Curve DAO Token (CRV) to USD calculator provides a clear breakdown of the costs. This includes the current market rate for CRV, any applicable service fees from our partners, and estimated network fees required for the blockchain transaction. Market volatility can affect the price of Curve DAO Token (CRV) in USD, so our system provides real-time quotes to ensure you have the most current information. This empowers you to make informed decisions without hidden charges. Our partners' secure payment gateway supports a wide array of payment methods, including:

- VISA/Mastercard/Maestro bank cards for quick and easy purchases.

- SEPA bank transfers for users in Europe, offering a reliable alternative.

- Apple Pay and Google Pay for frictionless mobile transactions.

- Support for other cryptocurrencies, including stablecoins like USDT and USDC, for crypto-to-crypto exchanges.

This flexibility ensures you can choose the payment method that best suits your needs and location, making the process of buying CRV more accessible than ever. All transactions are protected by industry-standard security protocols like SSL and TLS encryption, safeguarding your data throughout the process.

Securely Managing Your CRV Tokens

Upon purchasing CRV through the service provided by Switchere's partners, the tokens are sent directly to a Curve DAO Token (CRV) wallet address that you provide. It is crucial to have a secure, non-custodial digital wallet before initiating a purchase. Since Switchere is not a wallet provider, we encourage users to research and select a reputable third-party wallet that supports ERC-20 tokens like CRV. Popular choices include hardware wallets for maximum security or well-regarded software wallets for convenience. By taking ownership of your wallet, you retain complete control of your private keys and, consequently, your assets. We always recommend seeking independent financial advice to understand your risk tolerance and align your digital asset acquisitions with your broader financial goals.

An Advanced Platform for Your Crypto Acquisition Needs

Switchere is more than just a place to buy crypto; it's an advanced platform designed to provide secure and efficient access to the digital economy. Our focus is on creating a user-centric experience, removing the barriers often associated with acquiring DeFi tokens like Curve DAO Token (CRV). We achieve this through a combination of cutting-edge technology and strategic partnerships with industry leaders in payment processing and compliance. This collaboration ensures rapid transaction processing and swift settlements, meaning you receive your CRV in your designated wallet promptly after the purchase is confirmed. Our platform's infrastructure is built with security in mind, leveraging robust compliance and security measures to protect user information and facilitate safe transactions.

Our commitment to security is unwavering. While Switchere does not handle funds or perform exchanges directly, we meticulously vet our partners to ensure they meet stringent security standards, including protocols that align with ISO 27001 compliance for information security. Their dedicated fraud and security teams work around the clock to monitor transactions and prevent illicit activities, providing an additional layer of protection. User authentication measures are in place to secure your account, ensuring that you are the only one who can authorize transactions. This comprehensive approach to security, managed through our trusted network of partners, provides peace of mind when you use the Switchere platform to access and acquire digital assets.

Strategic Purchases and Long-Term Planning

For users looking to acquire CRV over time, Switchere offers features that support strategic planning. Our platform facilitates recurring crypto purchases, allowing you to set up automatic buys on a schedule that works for you. This feature is an excellent way to apply dollar-cost averaging principles, a strategy that involves buying a fixed dollar amount of an asset at regular intervals, regardless of market volatility. By averaging your purchase price over time, you can potentially mitigate the impact of price fluctuations. This disciplined approach can be beneficial for those with long-term financial goals who wish to build their position in assets like CRV systematically. Please note, this is an informational feature and should not be considered financial advice. It is essential to assess your own risk tolerance before setting up recurring purchases.

Getting Started with Switchere is Easy

Embarking on your journey to acquire Curve DAO Token (CRV) is simple. Our platform is designed for everyone, from beginners to experienced crypto users. Here is how you can get started:

- Create an Account: Register on the Switchere website or via our iOS or Android mobile app. The initial setup is quick and straightforward.

- Complete Verification: Undergo the verification process managed by our partners. Their flexible KYC system ensures compliance with international AML standards and secures the platform for all users.

- Choose Your Payment Method: Select from a wide range of options, including Visa/Mastercard/Maestro bank cards, SEPA, Google Pay, or Apple Pay.

- Specify Your Wallet Address: Provide the public address of your personal Curve DAO Token (CRV) wallet. Ensure it is an ERC-20 compatible wallet that you control.

- Confirm and Receive Your CRV: Review the transaction details, including all fees, using our price calculator. Once confirmed, our partners will process the transaction, and the CRV will be sent to your wallet.

With Switchere, you gain access to a powerful yet user-friendly service for acquiring Curve DAO Token (CRV) and other leading cryptocurrencies, all within a secure and compliant framework facilitated by our expert partners.

All currencies you can use

to buy Curve DAO Token right now — 40+ fiat currencies

Frequently asked questions

-

What's the fastest way to buy Curve DAO Token (CRV) with my card?

Using a credit or debit card on a trusted exchange is the quickest method. To instantly buy Curve DAO Token (CRV), simply register, verify your identity, link your card, and confirm the purchase. The CRV tokens are usually deposited into your account within minutes, streamlining your entry into DeFi. -

Is it secure to buy Curve DAO Token (CRV) with a credit card?

Absolutely. Reputable platforms use advanced security measures like 3D Secure and PCI DSS compliance to protect your transactions. When you buy Curve DAO Token (CRV) with your card, these protocols encrypt your data, ensuring a safe and secure purchase process from start to finish for your peace of mind. -

What do I need to buy Curve DAO Token (CRV) using a debit card?

To buy Curve DAO Token (CRV) with a debit card, you'll need a valid government-issued ID for verification (KYC), a compatible cryptocurrency wallet address if transferring out, and sufficient funds on your card. The process is straightforward, designed to get you started on our platform quickly and efficiently. -

Are there extra fees when I buy Curve DAO Token (CRV) with a card?

Yes, card purchases typically involve a processing fee from the payment provider and a service fee from the exchange. These fees cover the convenience and speed of the transaction. We provide a transparent breakdown of all costs before you confirm your order to buy Curve DAO Token (CRV). -

My card was declined when trying to buy Curve DAO Token (CRV). What should I do?

If your card transaction fails, first check if you have sufficient funds and that your card details are correct. Some banks block crypto purchases; contact your bank to authorize the transaction. This simple step often resolves the issue, allowing you to successfully buy Curve DAO Token (CRV) right away.