Convert

New Taiwan Dollar (TWD) to Balancer (BAL) Instantly

Purchase Balancer (BAL) with New Taiwan Dollar (TWD) easily at Switchere and benefit from fast, secure transactions.

About

Balancer (BAL)

Balancer (BAL) is a core piece of decentralized finance (DeFi) infrastructure, functioning as a highly flexible automated market maker (AMM) and liquidity protocol. Unlike traditional AMMs that often require 50/50 asset pairs, Balancer's key innovation is its use of customizable, multi-token liquidity pools, also known as smart pools. This allows anyone to create self-balancing portfolios or decentralized index funds where assets are held in specific, weighted proportions. This design not only provides deep, programmable liquidity for traders but also creates arbitrage opportunities that drive the pools back to their intended weighting, effectively automating portfolio management for liquidity providers on its decentralized network.

The protocol's evolution to Balancer V2 introduced a groundbreaking single Vault architecture. This design separates the AMM logic from the token management and accounting, massively improving gas efficiency and capital efficiency. All trades within the Balancer ecosystem are routed through this single Vault, enabling complex multi-hop trades to be executed with significantly lower transaction costs. The native digital asset of the protocol, BAL, serves as a critical governance token. Holders of the BAL utility token can participate in on-chain governance, voting on protocol upgrades, fee changes, and directing the allocation of liquidity mining rewards, thereby shaping the future of this essential Web3 infrastructure.

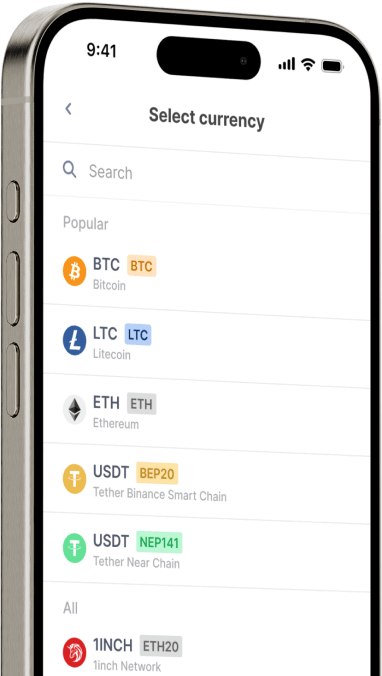

Buy Other 150+ Cryptocurrencies for New Taiwan Dollar (TWD)

Other Coins for New Taiwan Dollar (TWD)

-

TWD to ZRX

-

TWD to 1INCH

-

TWD to AAVE

-

TWD to ACH

-

TWD to ALGO

-

TWD to TLM

-

TWD to ANKR

-

TWD to APE

-

TWD to NFT

-

TWD to API3

-

TWD to APT

-

TWD to ARPA

-

TWD to AUDIO

-

TWD to AVAX

-

TWD to AVAX

-

TWD to AXS

-

TWD to BADGER

-

TWD to BAL

-

TWD to BNT

-

TWD to BAT

-

TWD to BNB

-

TWD to BUSD

-

TWD to BSW

-

TWD to BSV

-

TWD to BLUR

-

TWD to BONE

-

TWD to CTSI

-

TWD to CELR

-

TWD to CELO

-

TWD to CEL

-

TWD to LINK

-

TWD to CHZ

-

TWD to CHR

-

TWD to C98

-

TWD to COMP

-

TWD to CFX

-

TWD to PEOPLE

-

TWD to CVX

-

TWD to ATOM

-

TWD to CTC

-

TWD to CRV

-

TWD to DAI

-

TWD to DASH

-

TWD to MANA

-

TWD to DENT

-

TWD to DGB

-

TWD to LEASH

-

TWD to DYDX

-

TWD to XEC

-

TWD to EOS

-

TWD to ETC

-

TWD to ENS

-

TWD to ETHW

-

TWD to FET

-

TWD to FIL

-

TWD to FLOKI

-

TWD to GALA

-

TWD to GNO

-

TWD to ONE

-

TWD to HBAR

-

TWD to HOT

-

TWD to HOOK

-

TWD to ICX

-

TWD to ILV

-

TWD to IMX

-

TWD to INJ

-

TWD to ICP

-

TWD to IOST

-

TWD to IOTX

-

TWD to JASMY

-

TWD to JST

-

TWD to KAVA

-

TWD to KCS

-

TWD to KSM

-

TWD to KNC

-

TWD to LDO

-

TWD to LQTY

-

TWD to LPT

-

TWD to LOOKS

-

TWD to LRC

-

TWD to LUNA

-

TWD to MKR

-

TWD to MASK

-

TWD to EGLD

-

TWD to ALICE

-

TWD to NEAR

-

TWD to XEM

-

TWD to NEXO

-

TWD to NOT

-

TWD to NMR

-

TWD to OKB

-

TWD to OMG

-

TWD to ONT

-

TWD to EDU

-

TWD to OP

-

TWD to OGN

-

TWD to CAKE

-

TWD to PAXG

-

TWD to PENDLE

-

TWD to DOT

-

TWD to POL

-

TWD to QTUM

-

TWD to QNT

-

TWD to RDNT

-

TWD to XRD

-

TWD to RVN

-

TWD to REN

-

TWD to RSR

-

TWD to RLC

-

TWD to RPL

-

TWD to SFP

-

TWD to SHIB

-

TWD to SKL

-

TWD to SXP

-

TWD to STND

-

TWD to STG

-

TWD to XLM

-

TWD to GMT

-

TWD to STORJ

-

TWD to STMX

-

TWD to SUSHI

-

TWD to SNX

-

TWD to USDT (NEP141)

-

TWD to USDT (FA2)

-

TWD to USDT (TRC20)

-

TWD to USDT (JETTON)

-

TWD to USDT (SPL)

-

TWD to USDT (ERC20)

-

TWD to USDT (AVAC)

-

TWD to USDT (BEP20)

-

TWD to USDT (Polygon)

-

TWD to XTZ

-

TWD to GRT

-

TWD to SAND

-

TWD to TFUEL

-

TWD to THETA

-

TWD to RUNE

-

TWD to TON

-

TWD to TUSD (BEP20)

-

TWD to TUSD (TRC20)

-

TWD to TWT

-

TWD to UOS

-

TWD to UMA

-

TWD to UNI

-

TWD to USDC (SPL)

-

TWD to USDC (Polygon)

-

TWD to USDC (OP)

-

TWD to USDC (TRC20)

-

TWD to USDC (BEP20)

-

TWD to USDC (BEP20)

-

TWD to USDC (AVAC)

-

TWD to USDC (ARB)

-

TWD to USDC (ERC20)

-

TWD to VET

-

TWD to VRA

-

TWD to WAXP

-

TWD to WOO

-

TWD to WLD

-

TWD to WBTC

-

TWD to WMINIMA

-

TWD to XDC

-

TWD to YFI

-

TWD to YGG

-

TWD to ZIL

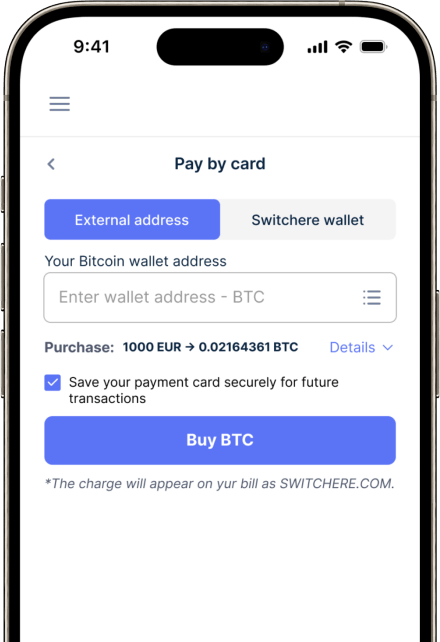

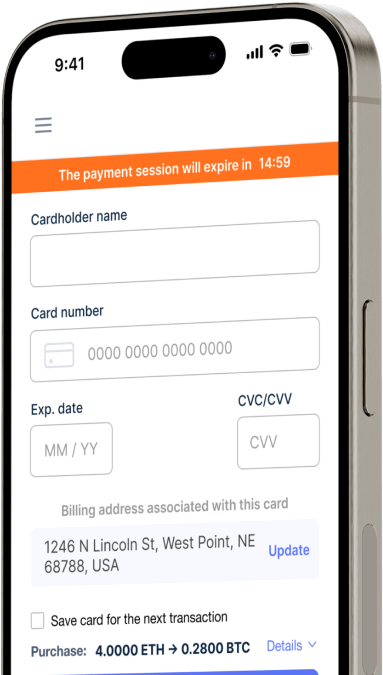

How to Buy Balancer (BAL)

Frequently Asked Questions

-

What is the TWD/BAL trading pair and how does it represent an investment in DeFi?

The TWD/BAL pair allows you to purchase Balancer's native governance token (BAL) using the New Taiwan Dollar (TWD). This transaction is a direct fiat on-ramp into the decentralized finance (DeFi) ecosystem, as BAL is integral to the Balancer protocol, a leading Automated Market Maker (AMM). Owning BAL allows participation in the protocol's governance and exposure to its innovative asset management capabilities.

-

What utility does the BAL token offer within the Balancer V2 ecosystem?

The BAL token is primarily a governance token. Holders can vote on Balancer Improvement Proposals (BIPs) to direct the future of the protocol. Additionally, BAL is used to incentivize liquidity providers in various weighted pools and can be staked to earn a share of the protocol's trading fees. This aligns the incentives of token holders with the long-term success of Balancer's Vault architecture and its Smart Order Router.

-

How does Balancer's Vault architecture affect transactions involving BAL?

Balancer V2 introduced a singleton Vault architecture that holds and manages all tokens from all Balancer liquidity pools. This design significantly improves gas efficiency. When you trade or interact with multiple pools, the tokens don't need to be transferred in and out of each pool contract; instead, the Vault handles the net balance changes internally. This is a key technical advantage when using your BAL tokens within the ecosystem for actions like multi-pool swaps or portfolio rebalancing.

-

What are the common methods for buying BAL tokens with TWD from Taiwan?

Typically, you would first use a regulated cryptocurrency exchange that accepts TWD deposits via local bank transfer. On this platform, you'd complete KYC/AML verification, deposit TWD, and then either trade directly for BAL if the pair is available, or more commonly, buy a major digital asset like ETH or USDT. You can then transfer this asset to a personal digital wallet and use a DeFi aggregator or the Balancer protocol itself to swap for BAL tokens.

-

What types of fees should I be aware of when converting TWD to BAL?

The process involves several potential fees. First, your bank or the cryptocurrency exchange may charge a fee for the TWD fiat deposit. Second, the exchange will have a trading fee for the TWD-to-crypto transaction. Finally, when you withdraw the BAL (an ERC-20 token) to a private wallet or interact with the Balancer protocol, you will incur Ethereum network gas fees. These gas fees are variable and depend on network congestion.

-

Once I've acquired BAL with TWD, how can I participate in yield farming on Balancer?

To participate in yield farming, you need to become a liquidity provider (LP). This involves depositing your BAL, often paired with another digital asset like WETH or a stablecoin, into one of Balancer's liquidity pools. In return, you receive LP tokens representing your share. You can then stake these LP tokens in a designated gauge to earn BAL rewards, in addition to the trading fees generated by your share of the pool. Always research the specific weighted pools and understand the risks of impermanent loss.