Acquistare criptovalute con carta di credito o carta di debito in modo semplice e veloce

Volete acquistare criptovalute con carta di credito in modo istantaneo, sicuro e senza commissioni nascoste? Con Switchere potete acquistare o vendere criptovalute all'istante - transando tutte le monete e i token più diffusi con un semplice tocco.

Come funziona

Come acquistare criptovalute con carta di credito su Switchere

Se vi state chiedendo come acquistare criptovalute con carta di credito su Switchere, non dovete preoccuparvi di queste banalità perché il processo di acquisto di criptovalute con carta di credito è semplificato al massimo. Ecco una semplice istruzione che illustra come acquistare criptovalute con carta di credito online su Switchere.

Perché scegliere noi

Vantaggi dell'acquisto di criptovalute con il nostro Crypto Exchange

Scoprite da soli quanto Switchere sia vantaggioso e intelligente! Acquistate criptovalute in pochi minuti e gestite il vostro portafoglio di criptovalute nel modo che preferite. Niente più attese ingombranti: acquistate criptovalute con carta di credito all'istante!

-

Elaborazione rapida dei pagamenti

Elaborazione delle transazioni 3DS fulminea e solidi standard di sicurezza PCI.

-

Varietà di metodi di pagamento

Carte bancarie VISA/Mastercard/Maestro, SEPA, Apple Pay, Google Pay, ecc.

-

Basse commissioni di cambio

Prezzi trasparenti e competitivi sul mercato per le operazioni di criptovaluta.

-

Assistenza clienti 24/7

Un team di assistenza clienti professionale e in prima linea è disponibile 24 ore su 24.

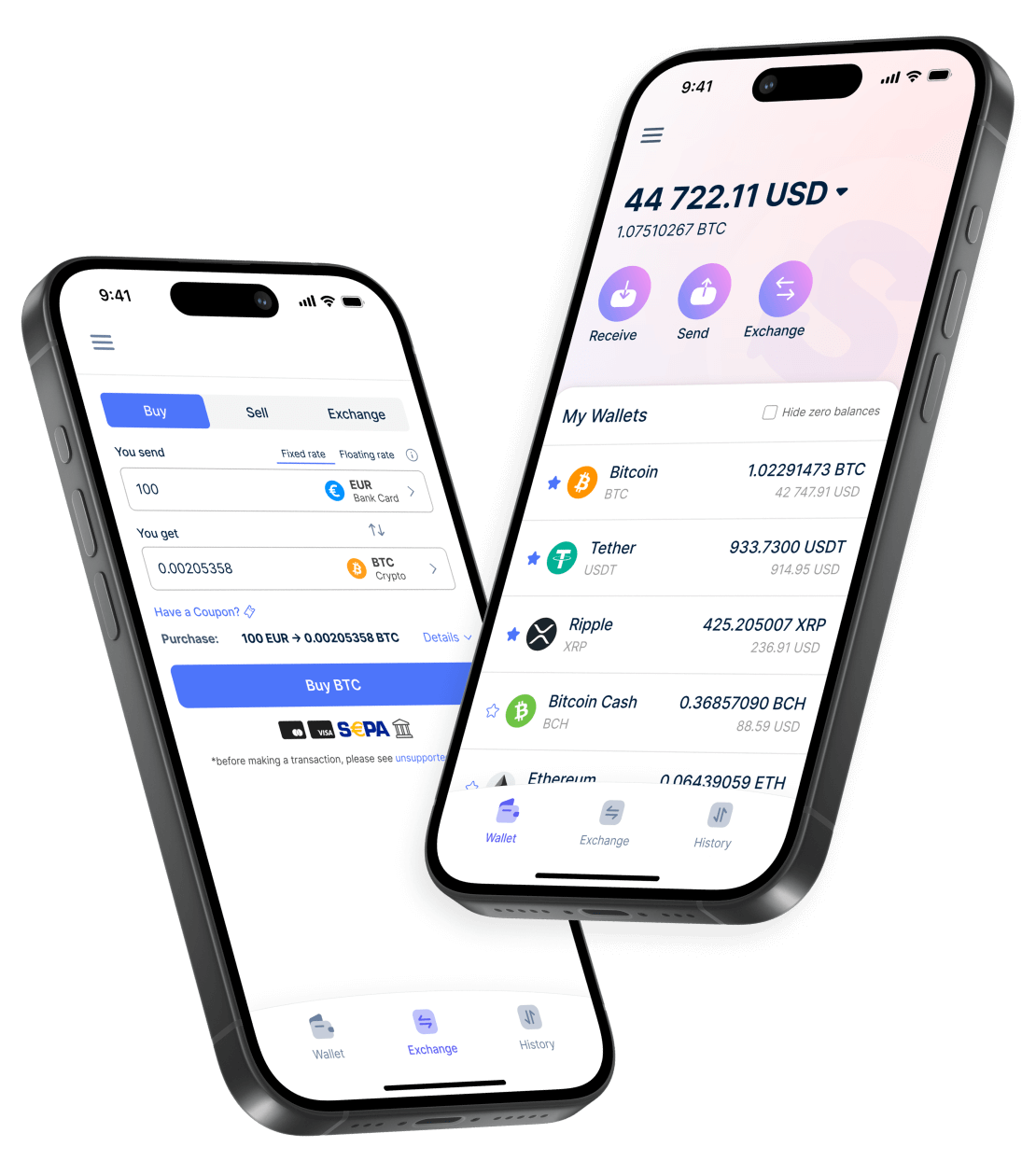

App mobile

Utilizzate l'app mobile Switchere per operazioni di crittografia intelligenti in movimento

Switchere offre l'applicazione mobile migliore della categoria e più adatta alle criptovalute, con tutte le funzionalità del crypto exchange Switchere web/desktop per soddisfare le esigenze di ogni utente esigente. Provate la vera libertà digitale con l'app mobile di Switchere, disponibile per dispositivi iOS e Android. Scaricate la nostra app Switchere e acquistate sempre e ovunque con un crypto exchange tascabile!

Da comprare

Le 10 principali criptovalute da acquistare ora

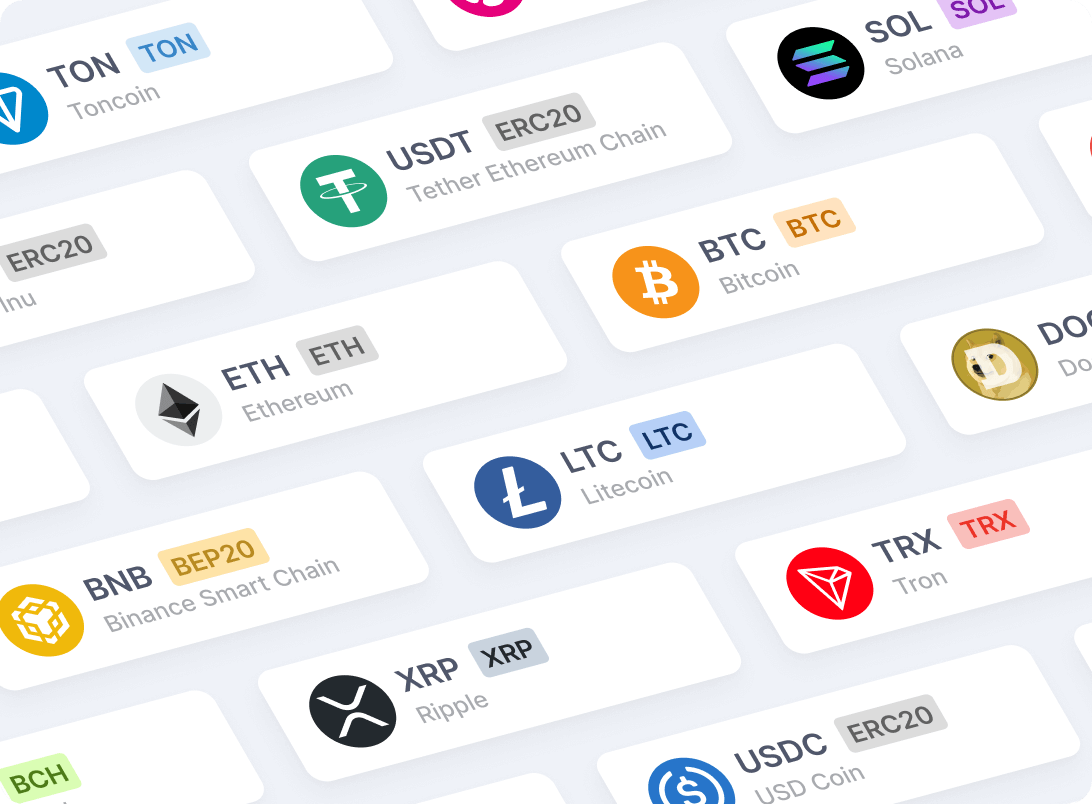

Monete

Le criptovalute con cui lavoriamo

Ottenete un facile accesso a tutte le criptovalute più popolari e importanti (BTC, ETH, XRP, stablecoin, token DeFi, ecc.). Potete acquistare criptovalute con una carta di credito e diversificare il vostro portafoglio di criptovalute in modo semplice e convincente.

Pagamento con carta

Switchere: Il tuo modo sicuro, protetto e istantaneo di acquistare criptovalute

Siete interessati al Bitcoin (BTC) e ad altri asset virtuali? Scambiate fiat in valute digitali ad alte prestazioni con la modalità turbo utilizzando Switchere - il vostro gateway di pagamento per criptovalute fidato, affidabile, rispettabile e autorizzato dall'UE. Raccogliete i frutti della vera rivoluzione digitale e acquistate criptovalute con una carta SOLO COSÌ!

Altre domande?