Compre criptomonedas con una tarjeta de crédito o débito rápida y fácilmente

¿Quiere comprar cripto con tarjeta de crédito de forma instantánea, segura y sin comisiones ocultas? A través de Switchere puede comprar o vender cripto al instante - realizar transacciones con todas las monedas y tokens populares con sólo pulsar un botón.

Cómo funciona

Cómo comprar criptomonedas con tarjeta de crédito en Switchere

Si se está preguntando cómo comprar cripto con una tarjeta de crédito en Switchere, no debe preocuparse por tales trivialidades porque el proceso de comprar cripto con una tarjeta de crédito está simplificado al máximo. A continuación le ofrecemos unas sencillas instrucciones sobre cómo comprar cripto con tarjeta de crédito en Switchere.

Por qué elegirnos

Ventajas de comprar criptodivisas con nuestro criptointercambio

¡Compruebe usted mismo lo ventajoso e inteligente que es Switchere! Compre cripto en minutos y gestione su cartera de cripto como desee. No más esperas engorrosas - ¡compre cripto con una tarjeta de crédito instantáneamente!

-

Procesamiento rápido de pagos

Procesamiento ultrarrápido de transacciones 3DS y sólidas normas de seguridad PCI.

-

Variedad de métodos de pago

Tarjetas bancarias VISA/Mastercard/Maestro, SEPA, Apple Pay, Google Pay, etc.

-

Bajas comisiones de cambio

Precios transparentes y competitivos en el mercado para las criptooperaciones.

-

Atención al cliente 24 / 7

Un equipo de atención al cliente profesional y de primera línea está disponible las 24 horas del día.

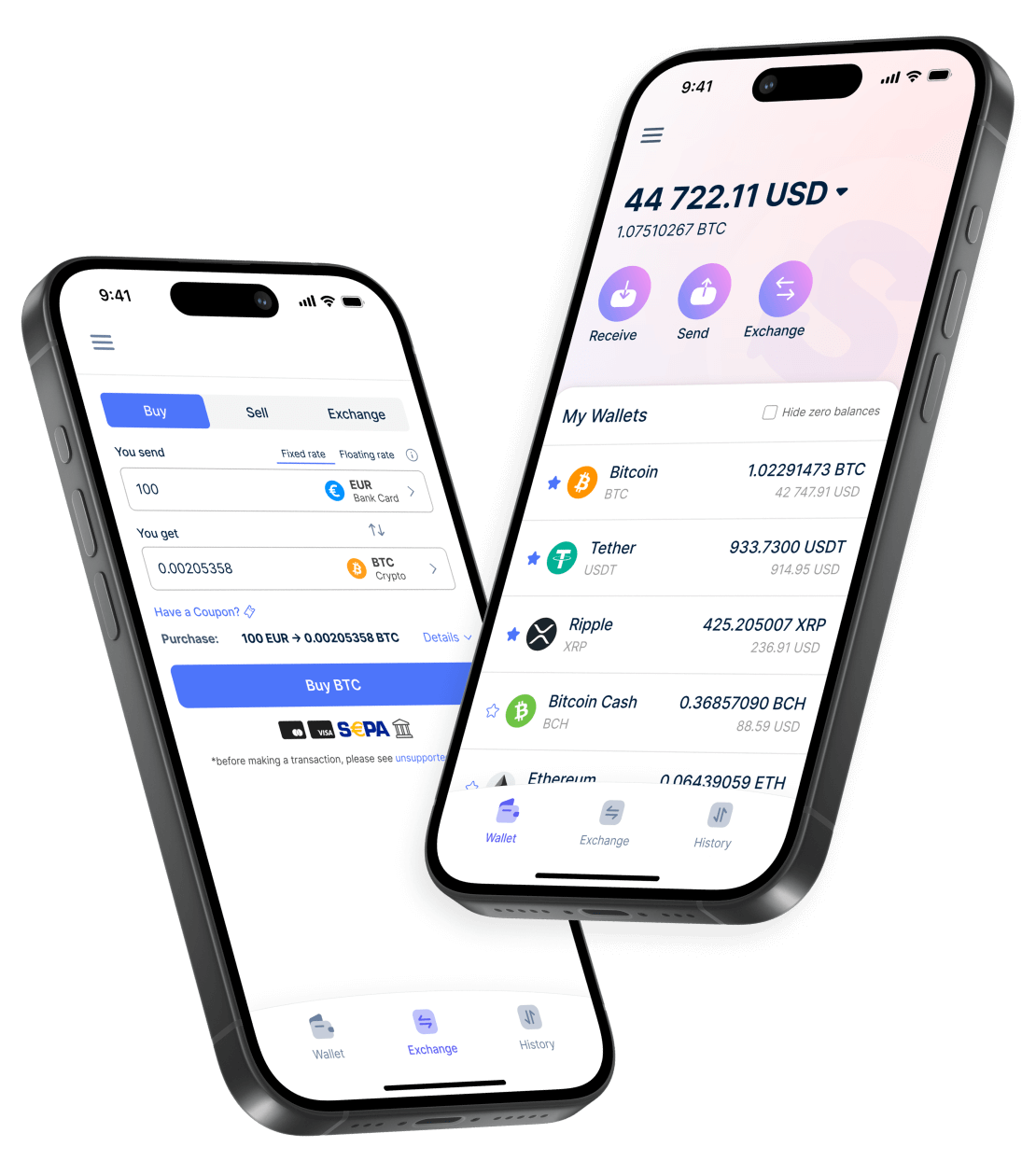

Aplicación móvil

Utilice la aplicación móvil Switchere para operaciones criptográficas inteligentes sobre la marcha

Switchere ofrece la mejor y más cripto-amigable aplicación móvil de su clase, con toda la funcionalidad de la bolsa de criptomonedas Switchere web/desktop para satisfacer las necesidades de cada usuario exigente. Siente la verdadera libertad digital con la aplicación móvil Switchere, disponible para dispositivos iOS y Android. Descargue nuestra aplicación Switchere y compre en cualquier momento y lugar con una criptobolsa de bolsillo.

De arriba a abajo

Las 10 mejores criptomonedas para comprar ahora

-

1NOT NotcoinNuevo Caliente

Comprar ahora

Comprar ahora -

2TON ToncoinNuevo Caliente

Comprar ahora

Comprar ahora -

3BTC Bitcoin

Comprar ahora

Comprar ahora -

4USDT TetherCaliente

Comprar ahora

Comprar ahora -

5XLM Stellar

Comprar ahora

Comprar ahora -

6ETH Ethereum

Comprar ahora

Comprar ahora -

7SOL Solana

Comprar ahora

Comprar ahora -

8LTC Litecoin

Comprar ahora

Comprar ahora -

9TRX TRON

Comprar ahora

Comprar ahora -

10XRP Ripple

Comprar ahora

Comprar ahora

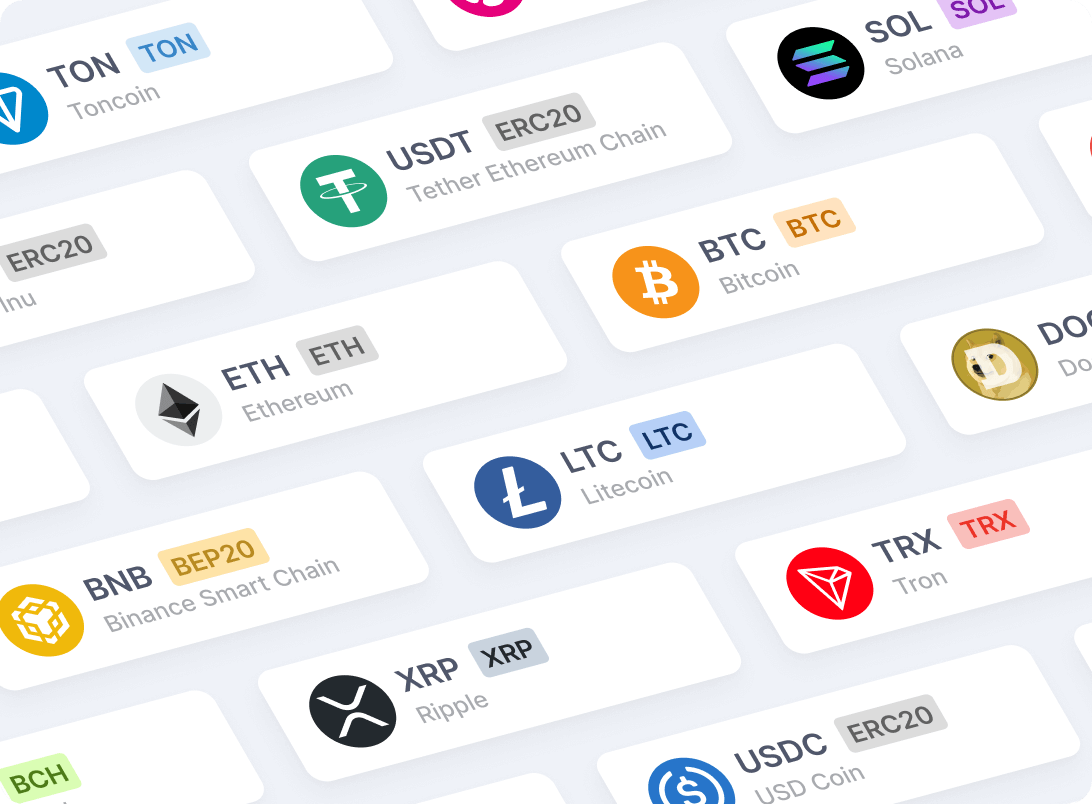

Monedas

Criptomonedas con las que trabajamos

Obtenga fácil acceso a todas las criptodivisas populares y líderes (BTC, ETH, XRP, stablecoins, tokens DeFi, etc.). Puede comprar criptodivisas con una tarjeta de crédito y diversificar su cartera de criptodivisas sin esfuerzo y de forma convincente.

Pagar con tarjeta

Switchere: Su forma segura e instantánea de comprar criptomonedas

¿Está interesado en Bitcoin (BTC) y otros activos virtuales? Cambie dinero fiduciario en divisas digitales de alto rendimiento con el modo turbo utilizando Switchere, su pasarela de criptopago de confianza, fiable, acreditada y autorizada por la UE. Coseche los frutos de la verdadera revolución digital y compre criptomonedas con una tarjeta ¡SIMPLEMENTE ASÍ!

¿Más preguntas?