Køb krypto med et kredit- eller betalingskort hurtigt og nemt

Vil du købe krypto med et kreditkort med det samme, sikkert og uden skjulte gebyrer? Gennem Switchere kan du købe eller sælge krypto med det samme - handl med alle populære mønter og tokens med et tryk på en knap.

Sådan fungerer det

Sådan køber du krypto med kreditkort på Switchere

Hvis du spekulerer på, hvordan du køber krypto med et kreditkort hos Switchere, skal du ikke bekymre dig om sådanne trivialiteter, fordi processen med at købe krypto med et kreditkort er forenklet til det maksimale. Her er en enkel instruktion, der fremhæver, hvordan du kan købe krypto med et kreditkort online hos Switchere.

Hvorfor vælge os

Fordele ved at købe kryptovaluta med vores kryptobørs

Se bare selv, hvor fordelagtig og smart Switchere er! Køb krypto på få minutter, og administrer din kryptoportefølje, som du vil. Ikke mere besværlig ventetid - køb krypto med et kreditkort med det samme!

-

Hurtig behandling af betalinger

Lynhurtig 3DS-transaktionsbehandling og robuste PCI-sikkerhedsstandarder.

-

Forskellige betalingsmetoder

VISA/Mastercard/Maestro-bankkort, SEPA, Apple Pay, Google Pay osv.

-

Lave vekselgebyrer

Gennemsigtig og markedskonkurrencedygtig prissætning for kryptooperationer.

-

24/7 kundesupport

Et professionelt kundeserviceteam i frontlinjen er tilgængeligt døgnet rundt.

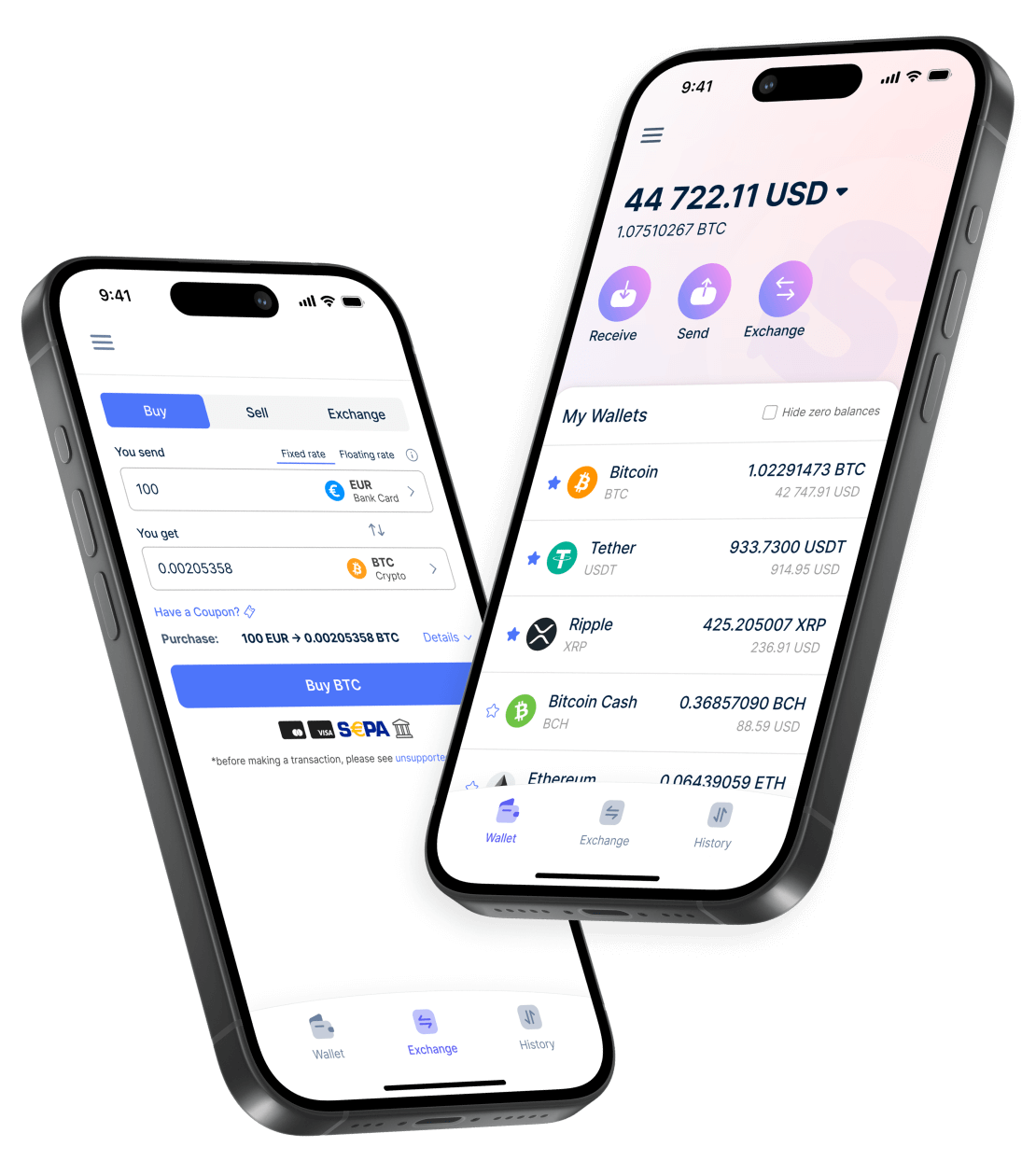

Mobil app

Brug Switchere-mobilappen til smarte kryptooperationer på farten

Switchere tilbyder den bedste og mest kryptovenlige mobilapp i sin klasse med alle funktionerne i Switchere web/desktop-kryptobørsen for at tilfredsstille enhver krævende brugers behov. Føl ægte digital frihed med Switchere-mobilappen, der er tilgængelig for iOS- og Android-enheder. Download vores Switchere-app, og køb når som helst og hvor som helst med en kryptobørs i lommestørrelse!

Top til køb

De 10 bedste kryptovalutaer at købe nu

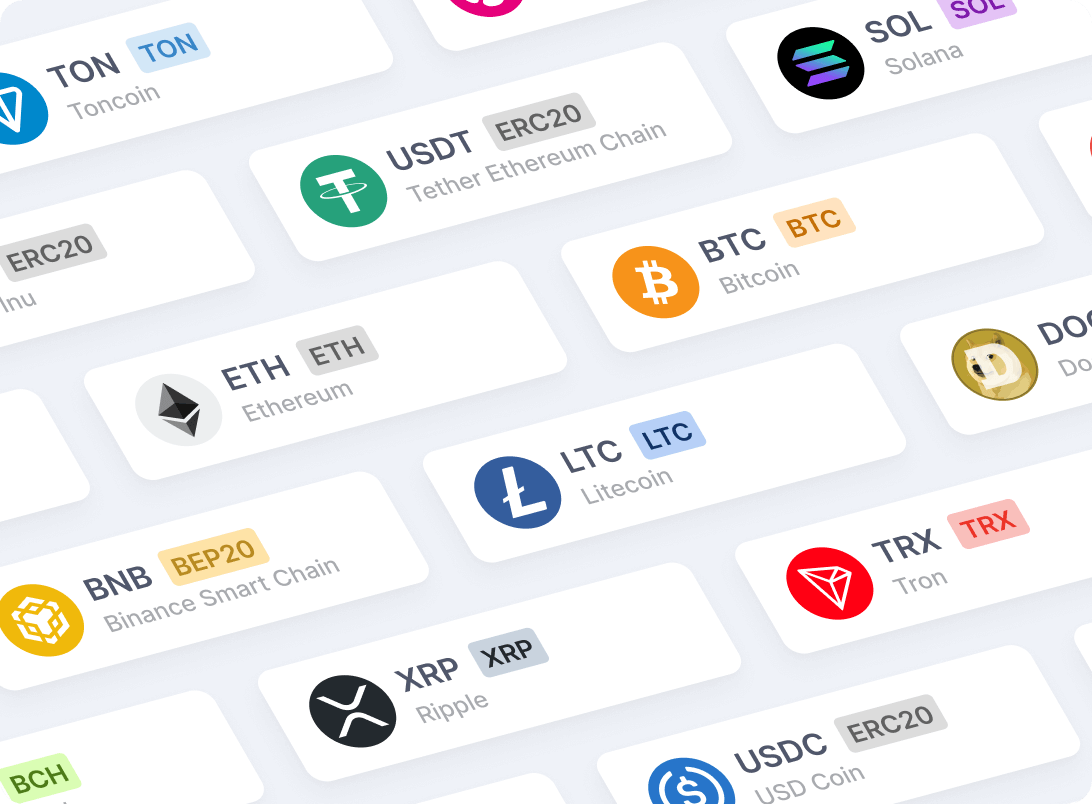

Mønter

Kryptovalutaer, vi arbejder med

Få nem adgang til alle populære og førende kryptovalutaer (BTC, ETH, XRP, stablecoins, DeFi-tokens osv.). Du kan købe kryptovaluta med et kreditkort og diversificere din kryptoportefølje uden besvær og på en overbevisende måde.

Betal med kort

Switchere: Din sikre og øjeblikkelige måde at købe krypto på

Er du meget interesseret i Bitcoin (BTC) og andre virtuelle aktiver? Byt fiat til de bedste digitale valutaer med turbotilstand ved hjælp af Switchere - din betroede, pålidelige, velrenommerede og EU-autoriserede kryptobetalingsgateway. Høst fordelene ved den ægte digitale revolution, og køb krypto med et kort LIGE SOM DET!

Flere spørgsmål?