Beyond the Hype: What Was the XRP Ledger Built For?

In a world saturated with blockchains, the XRP Ledger (XRPL) stands apart with a clear and specific mission: to revolutionize finance. From its inception, the XRPL was not a speculative experiment but a pragmatic, public, and decentralized infrastructure engineered to make moving value as fast and efficient as sending an email.

Its core purpose is to enable fast, low-cost, and scalable payments and asset transfers on a global scale. This focus makes it a powerful tool for various financial applications, including near-instant cross-border remittances, serving as a settlement layer for Central Bank Digital Currencies (CBDCs), facilitating accessible micropayments, and enabling the tokenization of real-world assets. While often associated with the company Ripple, the XRPL is open, permissionless technology. Its native digital asset, XRP, serves as a crucial bridge currency, providing on-demand liquidity and ensuring the network remains efficient and affordable.

Forging a New Ledger: The Architects of a Financial Revolution

The story of the XRPL began in 2011 with three developers: David Schwartz, Jed McCaleb, and Arthur Britto. Observing the limitations of Bitcoin's Proof-of-Work algorithm—particularly its slow transaction times and high energy consumption—they set out to build a superior system. Their goal was a ledger purpose-built for financial transactions, prioritizing speed, scalability, and sustainability.

They conceived a new consensus mechanism that avoided the competitive, energy-intensive process of mining. In 2012, they founded a company, initially called NewCoin and later renamed Ripple, to realize this vision. While Ripple has since become a major contributor to the XRPL ecosystem, the ledger itself is and always has been open-source technology. It was not created by Ripple but preceded it, with its development now stewarded by a global community of developers and validators.

Engineered for Enterprise: Fast, Green, and Ready to Scale

The technical advantages of the XRP Ledger make it a compelling platform for businesses and financial institutions. It was designed from day one for performance, delivering a suite of features that set it apart from many other blockchains.

Key performance characteristics include:

- Speed: Transactions on the XRPL achieve finality in just 3-5 seconds. This confirmation is absolute and irreversible, providing the certainty required for high-value financial operations.

- Scalability: The network is built for high throughput, consistently processing up to 1,500 transactions per second (TPS) with the potential to scale even further.

- Low Cost: The standard transaction cost on the XRPL is a fraction of a cent, typically around 0.00001 XRP. This makes it economically viable for everything from large-scale institutional settlements to micropayments.

- Eco-Friendly: As it does not use mining, the XRPL is incredibly energy-efficient. It is one of the first major blockchains to be carbon-neutral, a critical consideration for enterprises with sustainability mandates.

From Code to Commerce: Where the XRPL is Making its Mark

While its foundation is in payments, the XRPL's impact extends far beyond simple value transfer. Its built-in features for custom tokenization and a decentralized exchange have fostered a vibrant ecosystem of innovation. The ledger allows anyone to issue custom assets, known as tokens, representing virtually any form of value—from stablecoins and securities to loyalty points.

This capability has opened the door to a new wave of decentralized finance (DeFi) on the platform. For example, an investment firm could tokenize shares in a commercial building, allowing for fractional ownership and liquid trading on the XRPL's native decentralized exchange (DEX). This process, once confined to complex and costly traditional financial systems, becomes accessible and efficient. Furthermore, the introduction of an Automated Market Maker (AMM) protocol allows for automated, on-chain liquidity provision, expanding the financial capabilities available directly on the ledger.

The Power of Many: Inside the XRPL's Global Developer Community

The continued evolution of the XRP Ledger is driven not by a single entity but by a diverse, global community of open-source contributors. This collaborative ethos is fundamental to its resilience and innovation. The primary resource for this community is xrpl.org, a comprehensive portal offering documentation, tutorials, and tools for building on the platform.

Developers can interact with the XRPL using popular programming languages, thanks to robust Software Development Kits (SDKs) available for Python, Java, and JavaScript. This accessibility lowers the barrier to entry, empowering a wide range of builders—from individual entrepreneurs to large corporations—to launch new applications. The ecosystem is further supported by initiatives like the XRPL Grants program, which provides funding and support to promising projects, ensuring the ledger's functionality and use cases continue to expand.

Consensus, Not Conflict: How the XRPL Stays Secure and Swift

At the heart of the XRP Ledger's performance is its unique consensus mechanism. Unlike the competitive and energy-intensive Proof-of-Work (PoW) used by Bitcoin or the capital-intensive Proof-of-Stake (PoS), the XRPL uses a collaborative protocol.

A network of independent servers, known as validators, are responsible for agreeing on the order and outcome of transactions. Each validator processes transactions and compares its proposed ledger with those of its trusted peers. When a supermajority (at least 80%) of these validators agree that their ledgers match, the new ledger version is validated and cryptographically secured. This entire process occurs every 3-5 seconds. This system ensures network integrity and reliability without the massive energy consumption or centralization risks associated with mining, making the ledger inherently secure, fast, and decentralized.

Navigating the Maze: XRP and the Quest for Regulatory Clarity

It is impossible to discuss the XRPL without addressing the regulatory scrutiny it has faced, primarily through the U.S. Securities and Exchange Commission's (SEC) lawsuit against Ripple Labs. The case, filed in December 2020, alleged that Ripple's sales of XRP constituted an unregistered securities offering.

The dispute revolves around the Howey Test, a legal framework from the 1940s used to determine if an asset is an 'investment contract' and therefore a security. The SEC argued that people bought XRP with the expectation of profit based on Ripple's efforts, while Ripple contended that XRP is a digital commodity and an essential utility for the XRPL. Landmark court rulings have provided some clarity, finding that programmatic sales of XRP on exchanges did not constitute securities transactions, though direct institutional sales did. This ongoing legal battle has profound implications for the entire digital asset industry's pursuit of clear regulation.

Gateways to the Ledger: How to Access and Utilize XRP

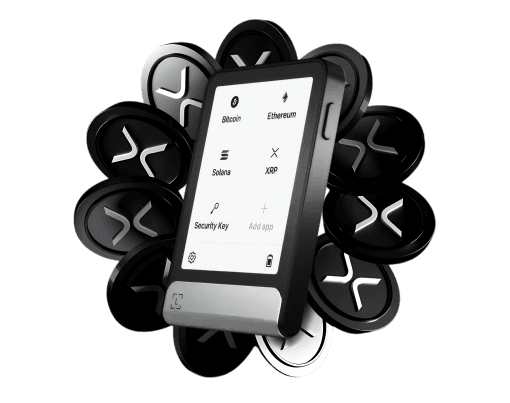

For most users, the primary way to acquire XRP is through established centralized exchanges like Binance, Kraken, and Bitstamp. These platforms offer liquid markets for trading XRP against fiat currencies and other digital assets.

However, the XRP Ledger also features powerful native trading capabilities. It includes one of the oldest on-chain decentralized exchanges (DEX) in the crypto space, allowing users to trade assets in a trustless, peer-to-peer manner directly from their own wallets. This is complemented by a native Automated Market Maker (AMM) function, where users can provide liquidity to pools to earn passive fees from trades. This dual structure—offering access via both centralized and decentralized venues—ensures robust market access for XRP and the thousands of other assets issued on the ledger.

The Economics of Utility: Understanding XRP's Role and Supply

The tokenomics of XRP are designed for utility and stability. The ledger was created with a finite supply of 100 billion XRP, and no more can ever be created. Unlike many other cryptocurrencies, there is no mechanism for inflation through mining or block rewards. In fact, the supply of XRP is deflationary.

Every transaction on the XRP Ledger requires a very small fee, a tiny fraction of one XRP, which is not paid to any party but is burned and destroyed forever. This serves two purposes: it protects the network from spam by making it expensive for malicious actors to flood the ledger, and it gradually reduces the total supply of XRP over time. The primary economic function of XRP is to act as a universal bridge currency, providing instantaneous liquidity between any two currencies on the ledger and eliminating the need for costly pre-funded accounts in traditional finance.

A Ledger for the Long Haul: The Enduring Vision of the XRPL

In an industry driven by fleeting trends, the XRP Ledger remains anchored by its original vision: to be a superior blockchain for finance. Its architecture, built for speed, efficiency, and real-world utility, has proven remarkably resilient. It successfully balances high performance with a commitment to decentralization and sustainability, a combination many newer networks still strive to achieve.

From facilitating more equitable global payments to powering a new generation of tokenized assets and DeFi applications, the XRPL continues to solve tangible problems. While regulatory headwinds have presented challenges, the underlying technology and its dedicated global community have continued to build and innovate. As the financial world increasingly embraces blockchain, the XRP Ledger stands as a foundational pillar, purpose-built for the future of value exchange.

Frequently asked questions

-

What was the XRP Ledger designed for?

The XRP Ledger (XRPL) was specifically designed to revolutionize finance by enabling fast, low-cost, and scalable global payments and asset transfers. Its core purpose is to function as a decentralized financial infrastructure, making the movement of value as efficient as sending an email. -

How does the XRPL achieve such fast transaction speeds?

The XRPL uses a unique consensus mechanism where a network of independent validators agrees on the order of transactions every 3-5 seconds. When a supermajority of at least 80% of these validators concur, the transaction is irreversibly confirmed. This collaborative process avoids the slower, energy-intensive mining of systems like Bitcoin. -

Is the XRP Ledger environmentally friendly?

Yes, the XRPL is highly energy-efficient. Because it does not use Proof-of-Work mining, its carbon footprint is negligible compared to many other major blockchains. It is considered one of the first major carbon-neutral blockchains. -

Who controls the XRP Ledger?

The XRP Ledger is an open-source, decentralized technology. It is not controlled by any single company, including Ripple. Its development and maintenance are managed by a global community of developers, and its network is secured by a diverse set of independent validators. -

What is the maximum supply of XRP?

The maximum supply of XRP was fixed at its creation at 100 billion. No more XRP can ever be created. The supply is deflationary, as the small fee required for every transaction is burned and permanently removed from circulation.