Kaufen Sie Krypto mit einer Kreditkarte oder Debitkarte schnell und einfach

Möchten Sie Kryptowährungen sofort, sicher und ohne versteckte Gebühren mit einer Kreditkarte kaufen? Mit Switchere können Sie Kryptowährungen sofort kaufen oder verkaufen - alle beliebten Münzen und Token mit nur einem Tastendruck abwickeln.

Wie es funktioniert

Wie man Krypto mit Kreditkarte am Schalter kauft

Wenn Sie sich fragen, wie Sie Krypto mit einer Kreditkarte bei Switchere kaufen können, sollten Sie sich nicht um solche Kleinigkeiten kümmern, denn der Prozess des Krypto-Kaufs mit einer Kreditkarte ist maximal vereinfacht. Hier ist eine einfache Anleitung, wie Sie Krypto mit einer Kreditkarte online bei Switchere kaufen können.

Warum uns wählen

Vorteile des Kaufs von Kryptowährungen mit unserer Krypto-Börse

Überzeugen Sie sich selbst davon, wie vorteilhaft und intelligent Switchere ist! Kaufen Sie Krypto in wenigen Minuten und verwalten Sie Ihr Krypto-Portfolio so, wie Sie es wünschen. Kein lästiges Warten mehr - kaufen Sie Kryptowährungen mit einer Kreditkarte, und zwar sofort!

-

Schnelle Zahlungsabwicklung

Blitzschnelle 3DS-Transaktionsverarbeitung und robuste PCI-Sicherheitsstandards.

-

Vielfältige Zahlungsmöglichkeiten

VISA/Mastercard/Maestro-Bankkarten, SEPA, Apple Pay, Google Pay, etc.

-

Niedrige Umtauschgebühren

Transparente und marktkonforme Preise für Kryptogeschäfte.

-

24 / 7 Kundenbetreuung

Ein professionelles Kundenbetreuungsteam ist rund um die Uhr verfügbar.

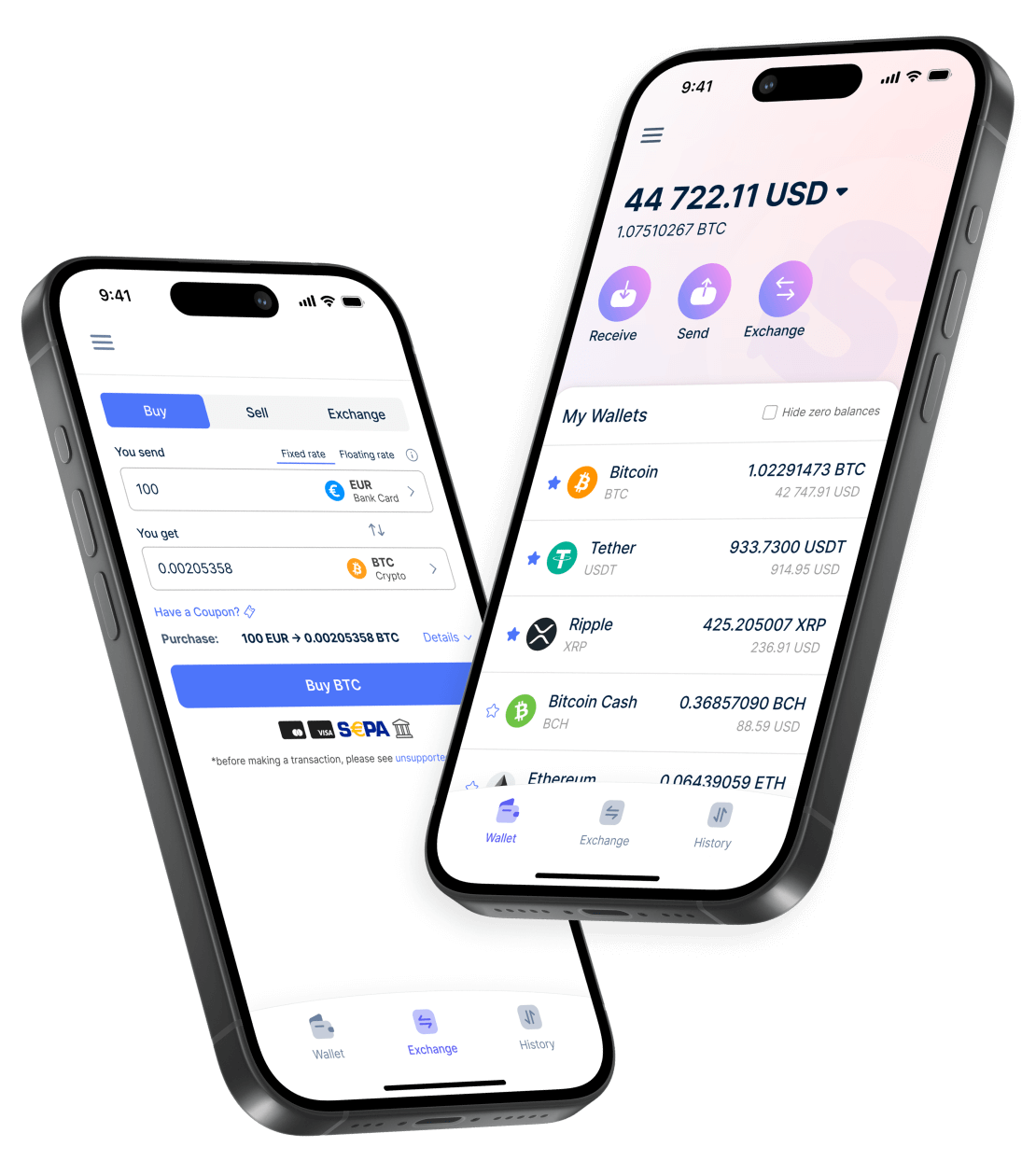

Mobile App

Nutzen Sie die Switchere Mobile App für intelligente Krypto-Operationen von unterwegs

Switchere bietet die klassenbeste und kryptofreundlichste mobile App, die alle Funktionen der Switchere Web-/Desktop-Kryptobörse bietet, um die Bedürfnisse jedes anspruchsvollen Nutzers zu erfüllen. Erleben Sie echte digitale Freiheit mit der mobilen App von Switchere, die für iOS- und Android-Geräte verfügbar ist. Laden Sie unsere Switchere-App herunter und kaufen Sie jederzeit und überall mit einer Krypto-Börse im Taschenformat!

Top zum Kaufen

Top 10 Kryptowährungen, die Sie jetzt kaufen sollten

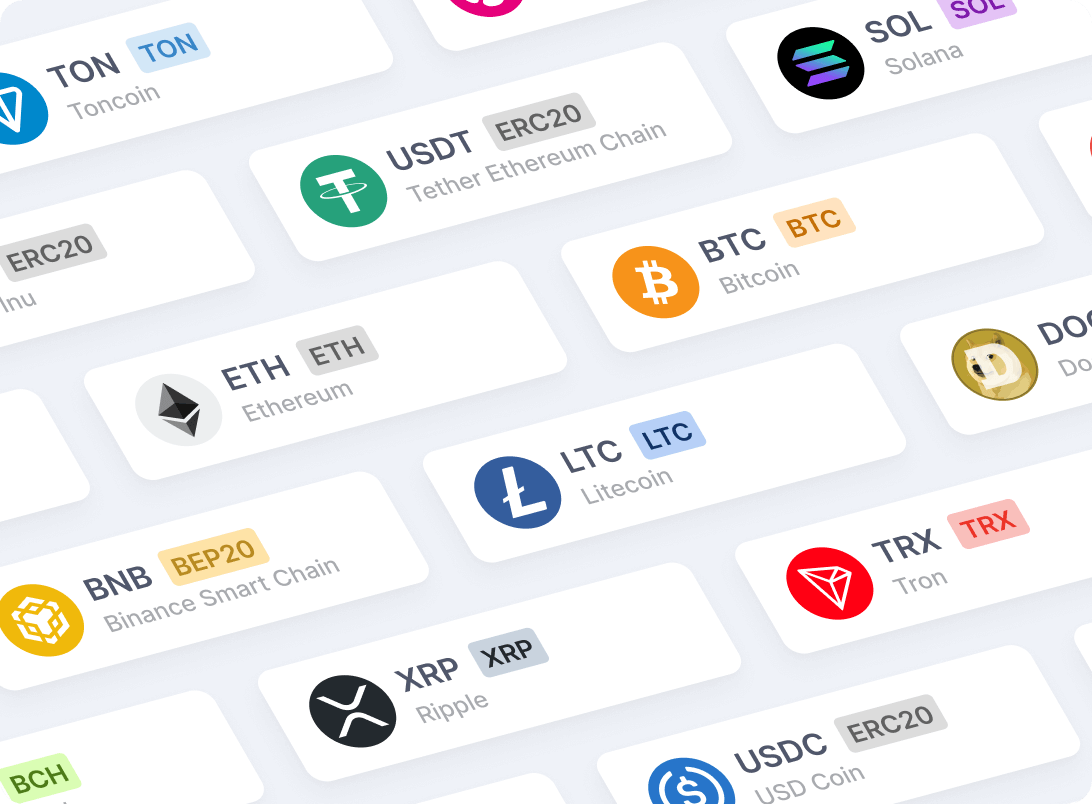

Münzen

Kryptowährungen, mit denen wir arbeiten

Erhalten Sie einfachen Zugang zu allen beliebten und führenden Kryptowährungen (BTC, ETH, XRP, Stablecoins, DeFi-Tokens, etc.). Sie können Kryptowährungen mit einer Kreditkarte kaufen und Ihr Krypto-Portfolio mühelos und überzeugend diversifizieren.

Mit Karte bezahlen

Switchere: Ihr sicherer und sofortiger Weg zum Kauf von Kryptowährungen

Interessieren Sie sich für Bitcoin (BTC) und andere virtuelle Vermögenswerte? Tauschen Sie Fiat-Währungen im Turbomodus mit Switchere - Ihrem vertrauenswürdigen, zuverlässigen, seriösen und EU-zugelassenen Krypto-Zahlungsgateway - in digitale Währungen mit Top-Performance. Profitieren Sie von der digitalen Revolution und kaufen Sie Kryptowährungen mit einer Karte JUST LIKE THAT!

Weitere Fragen?