신용 카드 또는 직불 카드로 암호 화폐 구매하기 빠르고 간편하게

숨겨진 수수료 없이 신용카드로 즉시 안전하게 암호화폐를 구매하고 싶으신가요? Switchere를 통해 즉시 암호화폐를 구매하거나 판매할 수 있으며, 버튼 하나만 누르면 모든 인기 코인과 토큰을 거래할 수 있습니다.

작동 방식

스위처에서 신용카드로 암호화폐를 구매하는 방법

Switchere에서 신용 카드로 암호화폐를 구매하는 방법이 궁금하다면, 신용 카드로 암호화폐를 구매하는 과정이 최대한 단순화되어 있으므로 이러한 사소한 일에 신경 쓰지 않으셔도 됩니다. 다음은 Switchere에서 온라인으로 신용카드로 암호화폐를 구매하는 방법을 강조하는 간단한 지침입니다.

선택해야 하는 이유

암호화폐 거래소를 통한 암호화폐 구매의 이점

스위처가 얼마나 유익하고 스마트한지 직접 확인해 보세요! 몇 분 안에 암호화폐를 구매하고 원하는 방식으로 암호화폐 포트폴리오를 관리하세요. 더 이상 번거롭게 기다릴 필요 없이 신용카드로 즉시 암호화폐를 구매하세요!

-

빠른 결제 처리

초고속 3DS 트랜잭션 처리 및 강력한 PCI 보안 표준.

-

다양한 결제 방법

비자/마스터카드/마에스트로 은행 카드, SEPA, 애플 페이, 구글 페이 등

-

저렴한 환전 수수료

암호화폐 운영을 위한 투명하고 시장 경쟁력 있는 가격.

-

24/7 고객 지원

전문 고객 지원팀이 24시간 대기하고 있습니다.

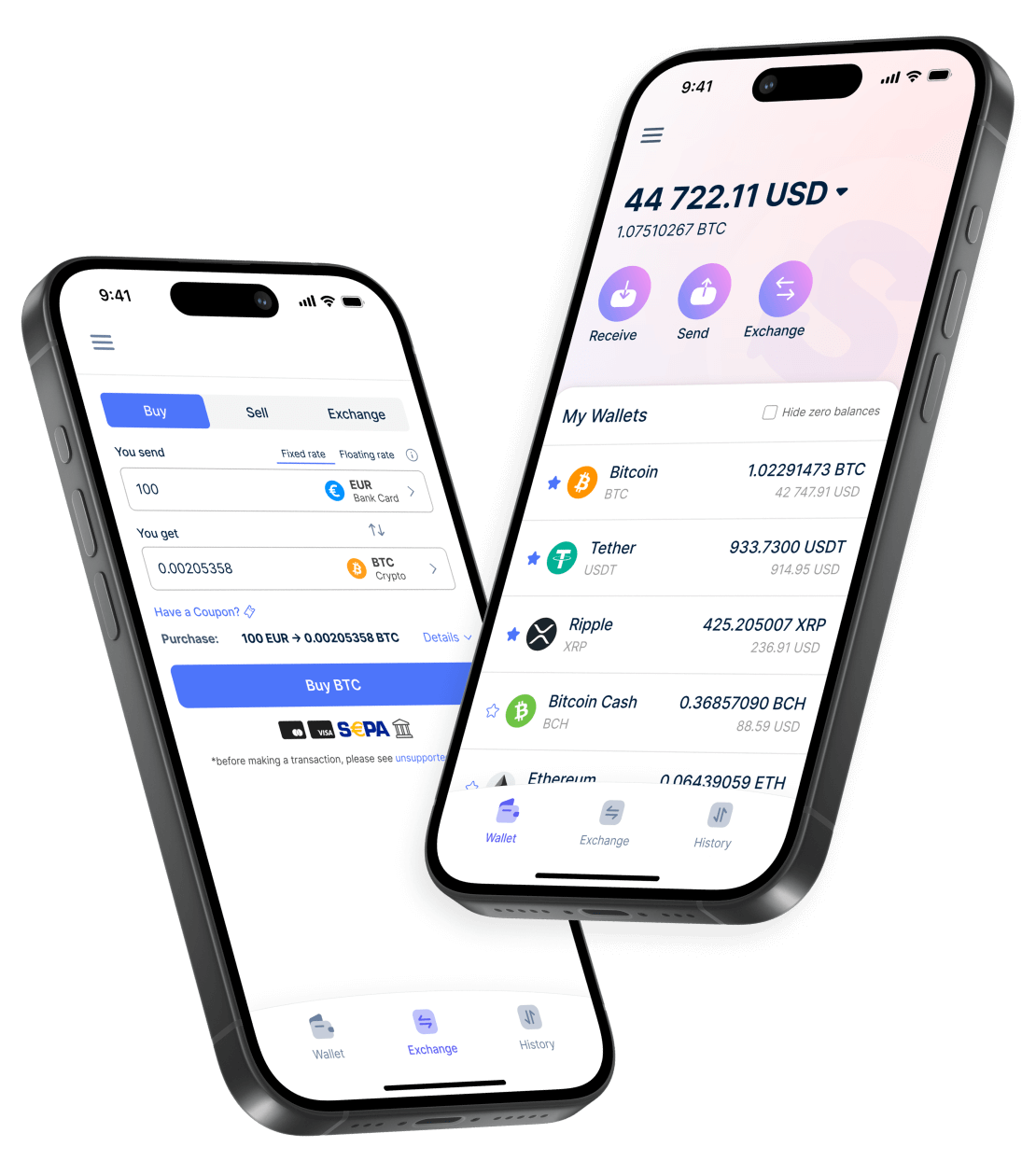

모바일 앱

이동 중에도 스마트한 암호화폐 운영을 위한 Switchere 모바일 앱 사용

Switchere는 모든 까다로운 사용자의 요구를 충족시키기 위해 Switchere 웹/데스크톱 암호화폐 거래소의 모든 기능을 갖춘 동급 최강의 암호화폐 친화적인 모바일 앱을 제공합니다. iOS와 안드로이드 기기에서 사용할 수 있는 Switchere 모바일 앱으로 진정한 디지털 자유를 느껴보세요. Switchere 앱을 다운로드하고 언제 어디서나 포켓 사이즈의 암호화폐 거래소에서 구매하세요!

구매하기

지금 구매해야 할 상위 10가지 암호화폐

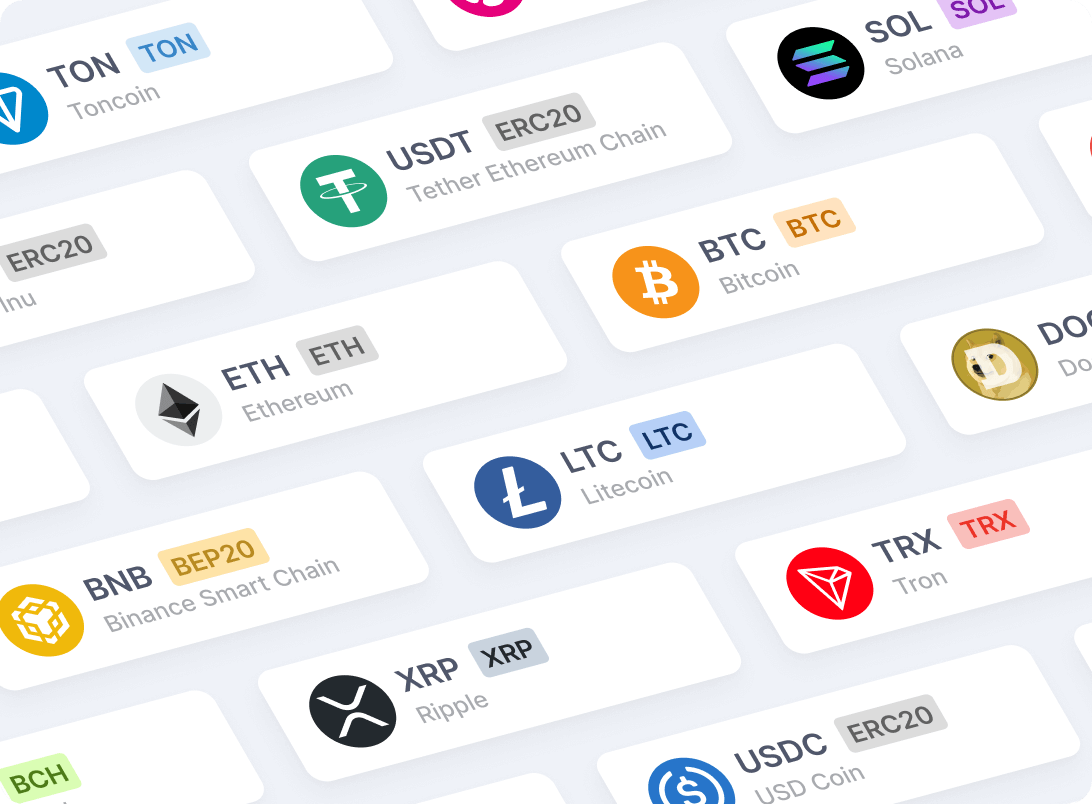

코인

당사가 사용하는 암호화폐

인기 있고 주요한 모든 암호화폐(BTC, ETH, XRP, 스테이블코인, 디파이 토큰 등)에 쉽게 액세스할 수 있습니다. 신용카드로 암호화폐를 구매하고 쉽고 확실하게 암호화폐 포트폴리오를 다양화할 수 있습니다.

카드 결제

스위처: 암호화폐를 안전하고 안전하게 즉시 구매할 수 있는 방법

비트코인(BTC) 및 기타 가상 자산에 관심이 많으신가요? 신뢰할 수 있고 평판이 좋으며 EU에서 승인한 암호화폐 결제 게이트웨이인 Switchere를 사용하여 터보 모드로 법정화폐를 최고 성능의 디지털 통화로 교환하세요. 진정한 디지털 혁명의 보상을 누리고 바로 그 카드로 암호화폐를 구매하세요!

질문이 더 있으신가요?